Number 1 tip: Attend – End of financial year tax planning – Dr Steven Enticott

Date: Wednesday 20th of June

Time: 6.00pm to 7.15pm

Location: Kingston Arts Centre 979 Nepean Hwy Moorabbin – Opposite CIA Tax’s Office!

Parking is available at the rear of Kingston City Hall and the Train station 100m away

RSVP: 1300 242 829 or to sje@ciatax.com.au

The CIA tax checklist out in July The BIG tip whilst reviewing the checklist is to pull out a copy of last year’s tax return and review those items as a prompt for collating the data for this year’s tax return.

Co-contributions for super is something you should DO. A 50% matching rate on up to $1,000 of after tax contributions, so a maximum amount $500 FREE from the ATO into your super!!

Income must be under (plus reportable super and FBT) of $51,813 to potentially qualify, details:

https://www.ato.gov.au/Individuals/Super/In-detail/Growing/Super-co-contribution/

Small Businesses prepay your expenses where you can and don’t be too hasty getting out your invoices prior to June 30 if it’s been a great income year.

Don’t forget the $20,000 immediate deduction on assets has again been extended another 12 months (2018) for those with a turnover below $10m.

Stocktakes can be counted on Cost price, Replacement Price or even Actual values which is one of our greatest tax planning tools for those that carry stock.

Super contributions to be claimed in this tax year they need to be paid before June 30 and yes in many cases you should contribute to super for example; An average earner saves 19.5% of tax on their contribution so even if they put the money into the safe cash option of the fund they have already had one great investment year!. However if you are bit on the younger side burdened with a lot of bad debt (non-investment lending) then speak to us about doing the numbers on super contributions first

Super SGT Amnesty Late in paying super? Just don’t be, those days have ended.

There are no more excuses and the ATO are watching every single payment timing with draconian penalties pending. However, if you have been slightly remiss the ATO has one last amnesty brewing in the wings – Details attached and at: https://www.ato.gov.au/Tax-professionals/Newsroom/Superannuation/Superannuation-Guarantee-Amnesty/

(Also, a very handy tool to leverage an employer who hasn’t paid your super!!)

Employees make sure you have paid for all your work-related expenses prior to June 30. Bring costs forward when you’ve had a great income year as this tip becomes even more important.

Made a capital gain during the past year, for example, the sale or part sale of a business (including investments the business has made), shares or a property. If the answer is a ‘yes’ then you should be thinking about your options for managing the CGT liability. Start by looking for capital losses to offset the CGT liability (or losses carried forward from prior years) and consider selling out losses before June 30 to offset gains – call us to discuss other methods.

For the Federal Budget update click here

For the Victoria State Budget update click here

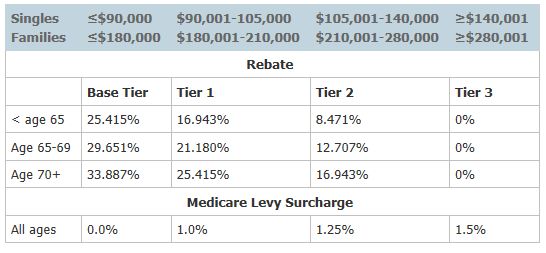

Medicare levy surcharge and Rebate Reduction income tests

For the rates of Medicare levy surcharge that applies or the amount of rebate you are entitled to see the rebate and surcharge levels applicable for 2017/8 are.

• Single parents and couples (including de facto couples) are subject to family tiers.

• For families with children, the thresholds are increased by $1,500 for each child after the first.

Superannuation Personal super contributions made that are to be claimed as a deduction (now that salary and wage earners can claim.) No major changes for 2019 tax year (phew!) For all of us the concessional cap payments into super are $25,000 includes super SG and salary sacrifices.

For under 65’s they may be able to also contribute $300,000* Non-Concessional all at once.

For over 65’s they will need to pass the work test and forget about it over 75 sadly.

*Superannuation has become so complex never contribute until you’ve cleared it with advisors

Superannuation Spouse Contribution of $3000 The amount of the offset is 18 per cent of the spouse contribution you make (max. offset of $540) reducing your own tax. Spouse income must be under $37,000 to get the full offset, then it gradually reduces to zero at $40,000.

Don’t forget – Sunglasses, Hats and Sunscreen for taxpayers that work in any outdoor occupation (including driving) they are tax deductible However they cannot be claimed unless you keep the receipt!

Repairs and maintenance on investment properties? Consider bringing forward so you can enjoy your tax deduction in the current financial year.

Pre-paying interest Say, on a loan of $300,000 it may cost $15,000 but it could get you up to $7350 back as a tax refund this year. Requires a negotiation with your lender!!

Claim Everything This one each year is a bit tongue in cheek, though correctly claiming expenses is our expertise. Your job is to think of absolutely anything that has a connection with your incomes and let us measure the appropriateness of claim.

SINGLE TOUCH PAYROLL (Shouting to get your attention!) – If you have 20 or more employees on 1 April 2018 it’s mandatory to adopt STP reporting for 1 July 2018 (everyone else at 1/7/19).

The Small Business Superannuation Clearing House (SBSCH) service has become part of ATO online services; that is the ATO online portal or you can log into your MyGov service.